MORTALITYVERIFICATION

DeathTrac delivers verified death reports to the pension plan on a weekly basis

Deah TracEnsuring Accuracy Beyond the End

Identifies Individuals

Identify Deaths – DeathTrac is an advanced death audit system designed specifically to identify individuals who have passed away yet are still listed as active pension recipients.

Its primary aim is to significantly reduce the risk of overpayments and prevent potential fraud in pension systems. By meticulously verifying the status of each pensioner, DeathTrac ensures that pensions are distributed only to living beneficiaries, thereby maintaining the integrity and financial stability of pension funds.

This proactive approach not only safeguards against financial losses but also upholds the principle of fair and accurate pension distribution.

Extracts Information

Extracts Information – Employing cutting-edge, proprietary algorithms, our system meticulously extracts and compiles data from a multitude of obituary databases.

This intricate process is designed to aggregate and synthesize the information into a single, comprehensive resource: the ABL Tech Obituary Database. This master database is a product of advanced technological innovation, where each piece of data is carefully analyzed and integrated.

This methodical approach ensures that the ABL Tech Obituary Database is not only extensive in its scope but also unparalleled in accuracy and reliability, serving as a vital tool in our ongoing efforts to provide the most up-to-date and complete obituary information.

Sweep Files & Databases

Our process includes comprehensive weekly sweeps against the Social Security Administration's Death Master File, along with various state databases, ensuring the most current and accurate information is captured. In addition to these weekly checks, we conduct daily sweeps of thousands of obituary databases. This rigorous and frequent examination of multiple sources allows us to gather a wealth of reliable data. By amalgamating and analyzing this information, we produce weekly reports that are not only up-to-date but also meticulously verified for trustworthiness. This layered approach, combining both broad and detailed sweeps, ensures that our reports provide a dependable and thorough overview, giving you the confidence to make informed decisions based on the most reliable data available.

Rapid Results

We consistently return verified and validated death results to the pension plan with a weekly frequency. Each week, our dedicated team diligently processes and verifies death data, ensuring the integrity and accuracy of the information. This process involves a thorough cross-checking of records from multiple trusted sources. Once validated, these crucial findings are swiftly compiled into a comprehensive report. This weekly report is then promptly delivered to the pension plan, providing them with timely, reliable data. Our commitment to rapid turnaround times, without compromising on precision and reliability, ensures that pension plans can quickly respond and adjust to the latest developments, effectively minimizing risks associated with overpayments and fraud

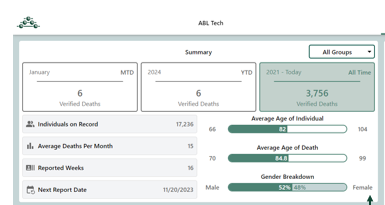

Deah TracDashboard

Simple User Interface Eliminate all manual work – just results

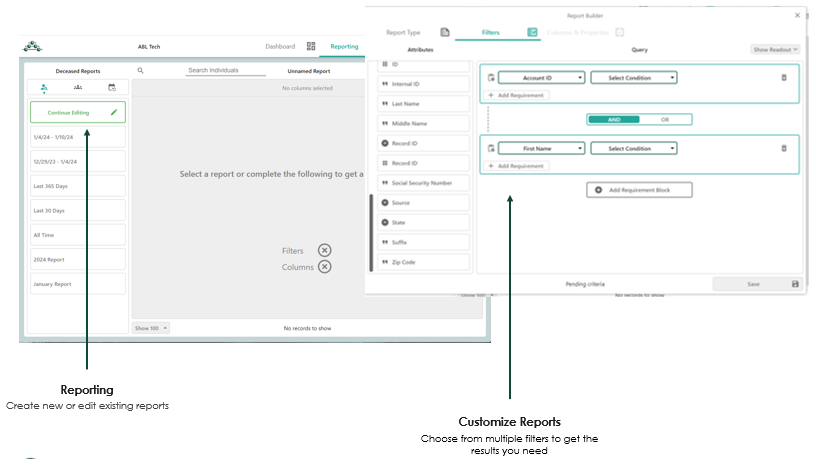

Deah TracReporting

Flexible Reporting

Customize the information you need.

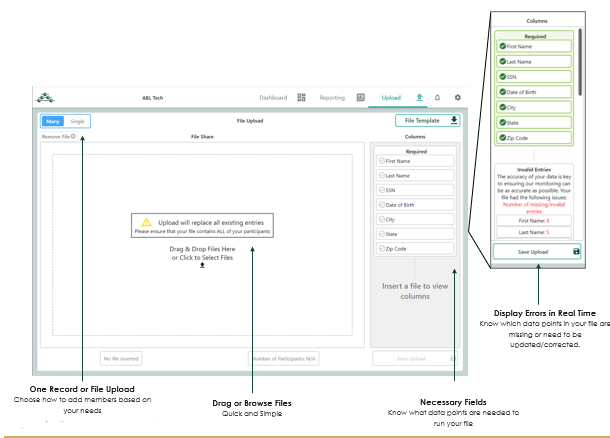

Deah TracFile Upload

Easy File Upload

Review and Correct all Your Data on site.

Our Suite of Outstanding Products

DeathTrac confirms participants’ deaths using databases and obituaries, ensuring accurate records and preventing fraud.

LifeTrac uses mail, phone outreach, and a detailed audit trail report to comply with Department of Labor and IRS guidelines for locating participants.

BeneTrac reunites missing relatives with entitled benefits post-participant’s passing, using commercial databases and thorough investigations.

Most Complete Death Data

Integrated SSA DMF, state data, obituaries, relative databases, and fuzzy logic analysis

Expertise

Integration of technology and subject matter experts using the latest techniques to achieve optimal results.

Technology

Advanced algorithms, cutting edge data science, and artificial intelligence embedded into proprietary systems.

Data Security

SOC 2 Certified, SSA DMF ACAB Certified, Data And Cyber Insurance, Dedicated Information Security Personnel, and Tier 3 Data Center.